Dive into the dynamic world of crypto trading with this essential guide! Whether you’re a beginner eager to learn or a seasoned trader looking to maximize returns, discover the strategic steps, expert insights, and real-world success stories that will empower your investment journey in 2024.

Introduction: The Promise of Crypto Trading in 2024

Crypto trading is not just a fad; it’s a burgeoning financial trend that promises significant returns and a transformative effect on personal finance and global economies alike. As we steer closer to 2024, the anticipation around cryptocurrencies continues to swell, fueled by technological advancements, regulatory developments, and a growing acceptance from mainstream financial entities.

🌟 Why Crypto Trading?

Crypto Trading offers a unique blend of opportunities that traditional markets often fail to provide. Here’s why you should consider diving into this exciting world:

- Volatility and High Return Potential: While volatility is often viewed as a risk, in the crypto world, it is synonymous with the opportunity for astronomical gains.

- Accessibility and Inclusivity: Anyone with an internet connection can become a crypto trader, breaking down barriers to entry in financial investment.

📈 Market Trends and Projections for 2024

The following key trends are shaping the future of crypto trading as we approach 2024:

- Increasing Institutional Investment

- Advancements in Blockchain Technology

- Global Regulatory Clarity and Support

These trends signify a maturing market that is increasingly stable and promising for potential traders.

🛠️ Tools and Resources for Every Crypto Trader

To navigate the world of crypto trading successfully, you’ll need the right tools and resources. Here’s what every trader should consider:

- Advanced Trading Platforms: Platforms that offer real-time analytics, automated trading, and in-depth market research.

- Secure Wallets: To keep your digital assets safe from theft and hacking.

- Learning and Community Engagement: Join forums, attend webinars, and read up-to-date content to stay ahead in the game.

📚 Educating Yourself for Success

The cornerstone of successful trading is knowledge. Here’s how to gear up:

- Understand the Crypto Basics

- Keep Abreast of Market Changes

- Learn Risk Management Techniques

🌍 The Broader Impact of Crypto Trading

Crypto trading’s impact transcends individual gains, offering promising solutions for economic issues on a global scale:

- Financial Inclusion: Cryptocurrencies can provide financial services to people without access to traditional banking systems.

- Promotion of Economic Decentralization: By reducing reliance on central financial authorities, crypto promotes a more equitable distribution of wealth.

🎯 Strategies for Maximizing Returns

To maximize your returns in crypto trading, you need robust strategies that can withstand the market’s volatility. Here are some strategies to consider:

- Diversification: Spread your investments across different types of crypto assets.

- Technical Analysis: Use charts and patterns to predict future movements.

- Fundamental Analysis: Evaluate the underlying factors driving market prices.

🚀 Launching Your Crypto Trading Journey in 2024

As the year 2024 approaches, positioning yourself advantageously within the crypto trading sphere is crucial. This involves being well-prepared with the right knowledge, tools, and mindset. Here’s how to start:

- Set Clear Goals: Determine what you want to achieve through crypto trading.

- Develop a Trading Plan: Tailor a strategy that fits your risk tolerance and investment goals.

- Stay Updated: Constantly refresh your knowledge as the market evolves.

By understanding these key elements, you are setting a strong foundation for potentially lucrative trading endeavors. The landscape of crypto trading in 2024 offers a promising horizon for those prepared to navigate its challenges and leverage its opportunities. Embrace the journey with the right tools, knowledge, and strategies, and you might find yourself riding the wave of the next big financial revolution.

Understanding the Basics of Crypto Trading

Crypto trading involves buying and selling digital currencies through exchanges in an effort to profit from price fluctuations. It’s essential for newcomers to grasp the fundamental concepts that govern the cryptocurrency markets. Here’s a breakdown to get you started:

📘 What is Cryptocurrency?

Cryptocurrencies are digital or virtual currencies secured by cryptography, making them nearly impossible to counterfeit. They are typically based on blockchain technology, which is a distributed ledger enforced by a disparate network of computers.

🔍 How Does Crypto Trading Work?

- Exchanges: Crypto trading occurs on platforms called exchanges where you can buy, sell, or trade cryptocurrencies for other digital currency or traditional currency like US dollars.

- Market Orders and Limit Orders: Traders use market orders for immediate transactions at the current market price, while limit orders are set to execute a trade at a specified price.

- Pairs Trading: In crypto, you’ll often trade pairs, such as BTC/USD, where you predict how one currency will perform against another.

📈 Understanding Market Trends

- Volatility: Cryptocurrencies are known for their swift price changes. This volatility can present opportunities for high returns, but it also comes with increased risk.

- Market Analysis: Traders often use either technical analysis, which involves studying statistical trends from trading activity, or fundamental analysis, which involves looking at external events and influences on the market.

🛠 Tools Every Trader Needs

- Charts and Patterns: Learning to read price action and chart patterns is crucial for predicting future market movements.

- Trading Bots: These can automate trading strategies and react faster than a human trader during market changes.

🌐 Risks Involved

- Market Risk: The high volatility means the market can swing unexpectedly due to external factors like regulations or technological breakthroughs.

- Security Risk: Trading also involves security risks like hacking. Ensuring you use secure platforms and keeping your wallet secure are paramount.

Understanding these basics provides a solid foundation for anyone interested in starting their journey in crypto trading. Knowledge is power, especially in a field as dynamic and potentially lucrative as cryptocurrency trading.

Who is Dirk de Bruin? A Crypto Expert’s Profile

Dirk de Bruin is a well-regarded cryptocurrency expert and educator with over a decade of experience in the crypto markets. His expertise spans across various aspects of cryptocurrency, including trading strategies, market analysis, and risk management.

🌟 Background and Expertise

- Experience: Dirk has been involved in the cryptocurrency space for many years, navigating its highs and lows with strategic acumen.

- Educational Initiatives: He is particularly noted for his educational contributions, providing resources and training for both novice and experienced traders.

🔍 Dirk’s Approach to Crypto Trading

- Educational Focus: Dirk emphasizes the importance of understanding the fundamentals of crypto trading and advocates for informed trading practices.

- Risk Management: His strategies often highlight the significance of managing risks to maximize returns in the volatile crypto market.

📚 Contributions and Influence

- Masterclasses and Webinars: Dirk offers masterclasses that cover various aspects of cryptocurrency trading, aimed at empowering individuals with the knowledge to succeed in the market.

- Public Speaker: He is a frequent speaker at industry conferences, where he shares insights about the future of cryptocurrencies and blockchain technology.

Dirk de Bruin has dedicated himself to demystifying the often complex world of cryptocurrencies, making it more accessible and understandable for the public through his educational efforts and public speaking engagements.

The 3-Step Strategy to Achieve 150x Returns

The allure of achieving 150x returns on your investment through crypto trading can be irresistible, but it requires a strategic and disciplined approach. This detailed guide will walk you through a three-step strategy designed to optimize your chances of such high returns in the volatile cryptocurrency market.

Step 1: Thorough Market Analysis

Before diving into investments, a comprehensive understanding of the crypto market is essential. This involves several key activities:

Market Trends and Economic Indicators

- Historical Data Analysis: Look at past price actions of potential coins.

- Current Market Conditions: Evaluate the overall health of the crypto market.

- Future Predictions: Stay informed about potential future developments in blockchain technology or regulatory changes.

Selecting the Right Cryptocurrencies

- Innovation and Use Case: Prefer coins that offer real-world applications and technological advancements.

- Community and Developer Support: A strong, active community and developer team can be a sign of a healthy crypto project.

Table 1: Top Cryptocurrencies to Watch

| Coin | Reason for Watch | Market Cap |

|---|---|---|

| Bitcoin | High liquidity | $1.398T ( March 31, 2024 ) |

| Ethereum | Smart contracts | $446.17B ( March 31, 2024 ) |

| Cardano | Scalability | $420 billion ( March 21, 2024 ) |

Step 2: Strategic Investment Planning

After selecting potential cryptocurrencies, crafting a detailed investment strategy is crucial.

Determining Entry and Exit Points

- Technical Analysis: Use tools like MACD and RSI to identify the best times to buy and sell.

- Sentiment Analysis: Gauge market sentiment through news sources and social media.

Risk Management

- Position Sizing: Calculate the appropriate amount to invest in each cryptocurrency.

- Diversification: Spread investments across various assets to mitigate risk.

Table 2: Example Trading Strategies

| Strategy | Description | Risk Level |

|---|---|---|

| Day Trading | Buy and sell on the same day | High |

| Swing Trading | Hold positions for several days to weeks | Medium |

| Long-term Holding | Buy and hold for months or years | Low |

Step 3: Advanced Trading Techniques

For those looking to maximize their returns, advanced trading techniques can be employed.

Using Leverage

- Margin Trading: Borrow money to increase potential returns, but be aware of the risks involved.

Automated Trading Systems

- Crypto Trading Bots: Use algorithms to make trades based on set criteria, which can help in managing the emotional aspect of trading.

Table 3: Popular Crypto Trading Bots

| Bot Name | Features | User Rating |

|---|---|---|

| Bot Example 1 | Automatic rebalancing | 4.5/5 |

| Bot Example 2 | Predetermined trading strategies | 4.0/5 |

Continuous Education and Adaptation

- Stay Updated: The crypto world evolves rapidly. Continuous learning is crucial.

- Adapt Your Strategies: Be ready to adjust your strategies based on new information or market shifts.

Risk Management Revisited

- Stop-Loss Orders: Set stop-loss orders to automatically sell at a predetermined price to limit potential losses.

- Regular Portfolio Reviews: Assess and adjust your portfolio regularly to ensure it aligns with your investment goals.

Psychological Factors

- Emotional Discipline: Maintain composure and stick to your strategy, avoiding impulsive decisions based on market hype.

Essential Tools for Crypto Traders

- Charting Software: For technical analysis.

- News Aggregators: To stay on top of market-moving news.

By meticulously applying these steps, traders can enhance their chances of achieving substantial returns. Each step requires careful consideration and execution to navigate the complexities of the crypto market effectively.

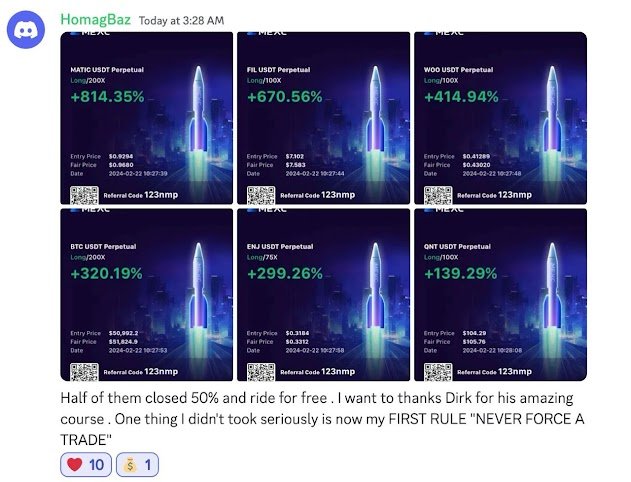

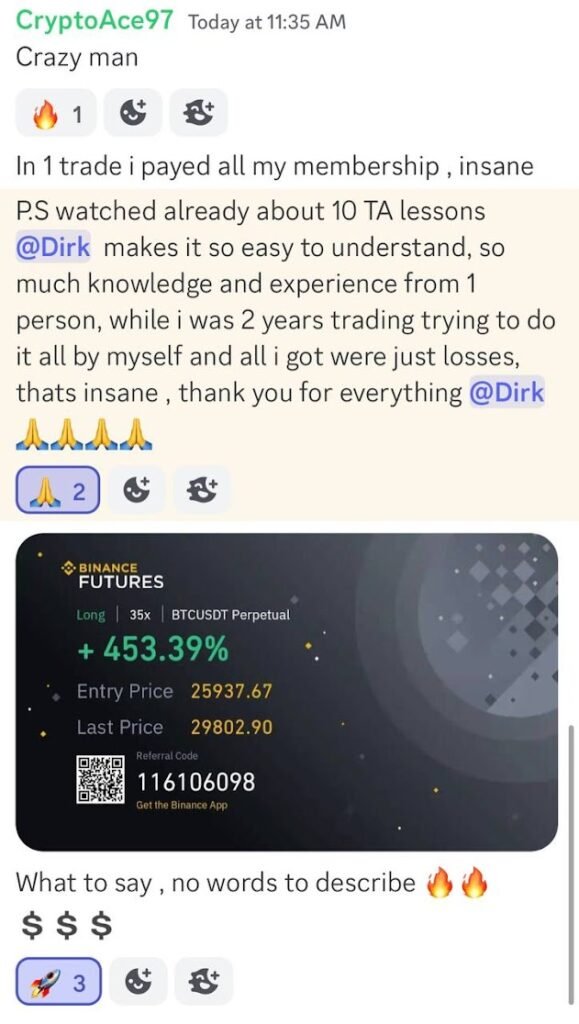

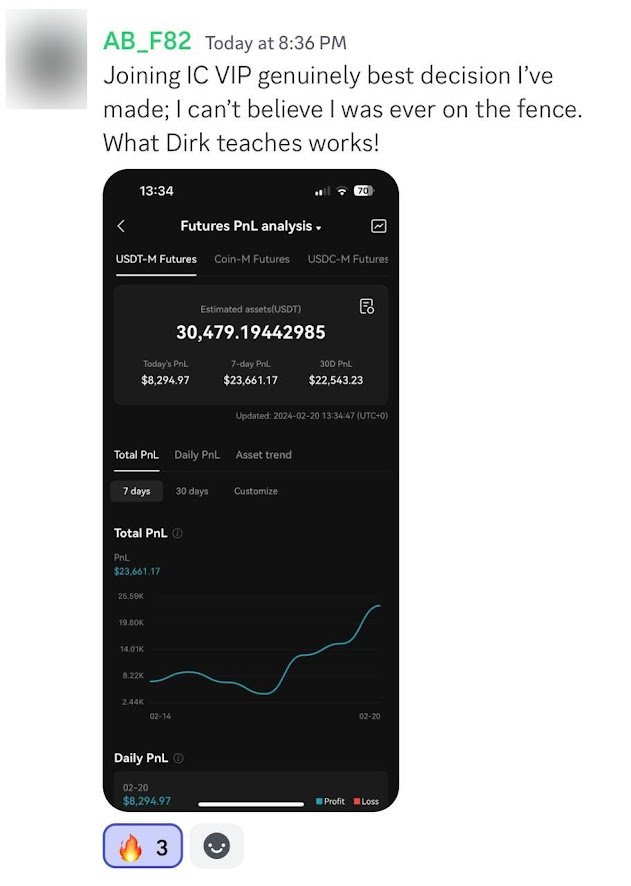

Real-World Success Stories: Testimonials from Dirk’s Students

Dirk de Bruin’s cryptocurrency course has garnered positive testimonials from numerous students who credit their success in crypto trading to his teachings. These testimonials highlight transformations from novice traders to confident investors, emphasizing gains made through strategies learned in his courses. Students particularly appreciate the actionable insights, detailed market analysis, and the supportive learning community Dirk fosters, which they say significantly contributed to their trading success. For more detailed testimonials, visiting the official website of Intelligent Cryptocurrency would provide firsthand accounts and specific success stories.

Conclusion: Starting Your Journey in Crypto Trading

Embarking on your journey in crypto trading is an exciting prospect that offers the potential for substantial financial rewards. As we’ve explored through Dirk de Bruin’s insights and strategies, success in this field requires more than just an understanding of the market; it necessitates a strategic approach, ongoing education, and rigorous risk management.

Education and Preparation: The first step in your trading journey should always be education. Understanding the fundamentals of blockchain technology, the specifics of various cryptocurrencies, and the dynamics of the crypto markets are crucial. Platforms like Dirk de Bruin’s offer comprehensive resources that can equip you with the necessary knowledge and skills.

Strategic Planning: Developing a clear trading strategy based on thorough market analysis and sound investment principles is vital. Decide whether you’re more suited to short-term trading or long-term investing, and plan your entry and exit strategies accordingly. Utilizing tools like technical analysis can significantly enhance decision-making processes.

Risk Management: Perhaps the most critical aspect of successful trading is effective risk management. It’s essential to set realistic goals and establish strict rules for when to take profits and cut losses. Diversifying your portfolio can also help mitigate risks associated with the volatility of the crypto market.

Community and Support: Joining a community of like-minded traders can provide not only support but also additional insights into market trends and strategies. The shared experiences and knowledge found in these communities can be invaluable, particularly for those new to trading.

Staying Informed: The crypto landscape is continuously evolving, with new developments occurring at a rapid pace. Staying informed about the latest news, regulatory changes, and technological advancements can provide you with an edge over other traders.

By taking these steps, you can better prepare yourself for the complexities and opportunities of crypto trading. Remember, while the potential for high returns is significant, so is the risk of loss. Therefore, approach trading with caution, commitment, and a willingness to continuously learn and adapt. Your journey in crypto trading could not only be lucrative but also profoundly educational and enriching.